- Hedera’s deal count blasts past the 12 billion deals turning point.

- HBAR brief liquidations reinforce bullish charge.

It is constantly intriguing to see how blockchain tasks reasonable when the marketplaces are down. Some such as Hedera [HBAR] appear to overlook the bearish market conditions by keeping healthy network activity.

Is your portfolio green? Take a look at the Hedera Revenue Calculator

Hedera is currently seeing take advantage of its concentrate on development, specifically now that the marketplace remains in a bullish healing stage. The network simply revealed that it crossed the 12 billion deal turning point. A remarkable task that highlights the ongoing concentrate on development.

#Hedera: 12 Billion Deals pic.twitter.com/dKkWmvfhND

— Hedera (@hedera) June 22, 2023

The above observation is very important specifically for Hedera fans questioning the fate of the network. This is due to the fact that it has actually been eclipsed by other leading blockchain networks, however the brand-new turning point validates that Hedera is still taking pleasure in healthy development.

Why liquidations have actually contributed in HBAR’s newest rally

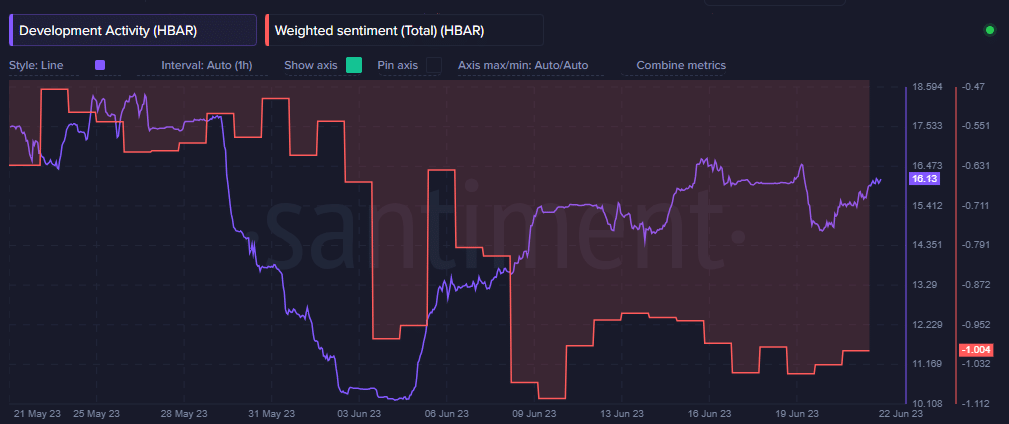

On-chain information exposed that Hedera kept healthy advancement activity given that the start of June. Hence, using more peace of mind to financiers concerning the state of the network. Regardless of this, the weighted belief metric has actually just recuperated somewhat from its most affordable level in the last 4 weeks.

The absence of correct stimulation in the weighted belief validates that financier belief is still low. Maybe an indication that financiers are not so positive in Hedera’s native cryptocurrency, HBAR. An observation that was likewise evident in the derivatives sector throughout the middle of the week.

The Binance financing rate showed a choice for unfavorable financing rates throughout the abovementioned duration. The financing rate has actually increased in the last 24 hours.

HBAR still handled to attain a sharp bounce back in the last 7 days throughout which it rallied by approximately 21% to its $0.050 press time cost tag. The upside especially started throughout mid-June after the cost briefly dipped into oversold area.

Source: TradingView

The rally was at first supported by low volumes however a take a look at the current volume spike in between 21 and 22 June recommends something intriguing. The spike might have been because of the subsequent bullish volume by liquidated brief traders required to purchase to cover losses.

Source: Santiment

Note that there were unfavorable financing rates throughout mid-week as mentioned previously. In addition, Coinglass information validated that there were greater brief positions on 20 and 21 June, showing that certainly numerous traders anticipated a bearish result.

Source: Coinglass

Realistic or not, here’s HBAR’s market cap in BTC’s terms

We can see based upon the above information that the liquidations have actually certainly added to bullish momentum. {However, volumes have actually gone back after the spike.

This implies lower need might move the present trajectory as the weekend methods, unless it can protect more bullish momentum.01001010.|Then once again, volumes have actually gone back after the spike.01001010 This implies lower need might move the present trajectory as the weekend methods, unless it can protect more bullish momentum.01001010.}